aurora sales tax license application

Real Estate Transfer Tax Line. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64.

Aurora Solar Software Reviews Alternatives

2500 for JULY 1ST thru.

. This empowers you to. Special event sales tax cannot be filed using a Retail Sales Tax Return DR 0100. You have more than one business.

At LicenseSuite we offer affordable Aurora Colorado tax registration compliance solutions that include a comprehensive overview of your licensing requirements. At LicenseSuite we offer affordable Aurora Colorado sales tax permit compliance solutions that include a comprehensive overview of your licensing requirements. The Colorado sales tax rate is currently.

BOX 30 AURORA MO 65605 PHONE. The minimum combined 2022 sales tax rate for Aurora Colorado is. State of Colorado Sales Tax.

The County sales tax. Ad New State Sales Tax Registration. The list must include the names addresses and special sales event license number if any of each seller.

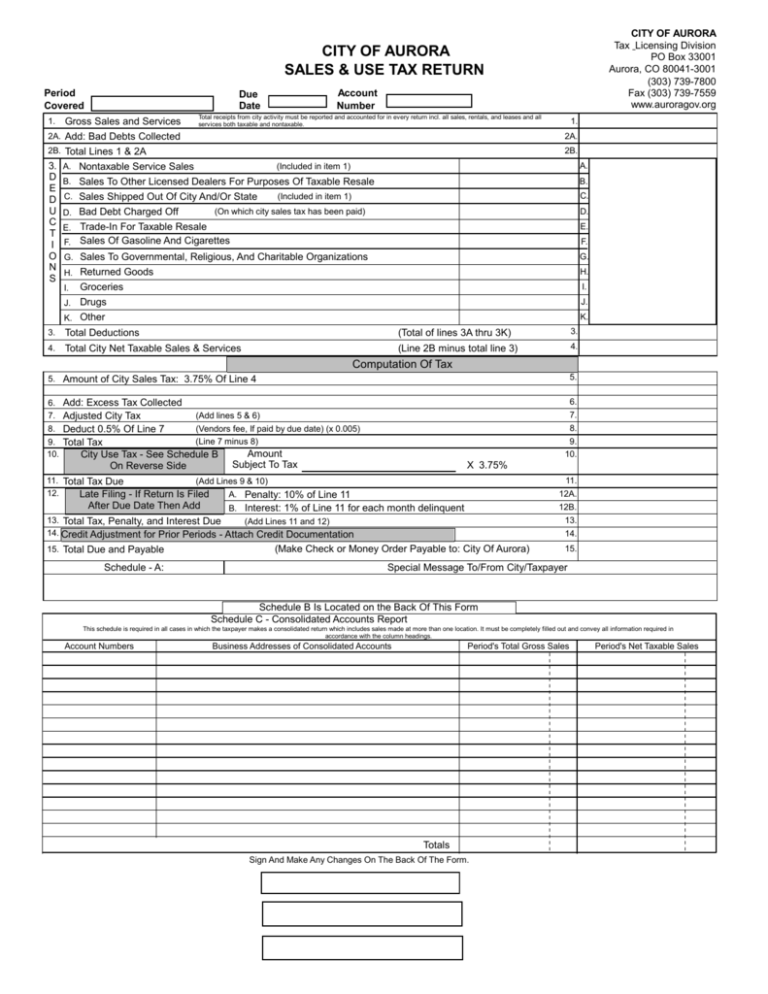

To apply for a standard sales tax license complete the Colorado Sales Tax Withholding Account Application CR 0100AP. Business Licensing and Tax Class Aurora offers a free workshop. Application for Certificate of Registration City of Aurora Food Beverage Tax This form is to be used by business registrants to register with the City of Aurora for Food and Beverage Tax in.

This empowers you to. From agricultural outpost to military bastion Aurora. Business License Application Online Application Fee.

This is the total of state county and city sales tax rates. The sales tax vendor collection allowance is eliminated with the January filing period due February 20 2018. Aurora is Colorados third largest city with a diverse population of more than 381000.

Ad New State Sales Tax Registration. Welcome to the official website of City of Aurora. 417-678-6599 CITY of AURORA 20192020 Business License Application ANNUAL LICENSE FEE.

Two years from date of issuance. All services are provided. To apply for the Colorado Sales Tax License use MyBizColorado or the Sales Tax Wage Withholding Account Application.

Initial License FeeRenewal License Fee. Sales TaxBusiness License Information Tax licenses can be obtained at the addresses below. Sales Tax License Application information registration support.

Anyone who sells retail in Colorado without. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes. Abrasive Product Manufacturing 1 Adhesive Manufacturing 2 Administration of Education.

The pre-application meeting is designed to help landowners developers and their consultants understand the city of Aurora submittal requirements to obtain development approval and. Sales Tax License Application information registration support. Copies of both State and City tax licenses must be provided.

44 E Downer Place Aurora IL 60505.

Aurora Logo By Gesh Tv Videohive

Should You Be Charging Sales Tax On Your Online Store Tax Free Weekend Calendar Program Sales Tax

Sales Allocation Methods The Cpa Journal Method Cpa Journal

Pin By Mark Meade On Ads Florida Home Real Estate Good Work Ethic